An Intro to Treasury Management for the Waco Entrepreneur

This month, we’ve already talked about why saving is so important for your business. (Check out the post if you haven’t seen it!) However, saving is really just one part of your business’ financial strategy. Other key pieces—a.k.a. spending, earning, and investing—must come together in perfect harmony to keep each dollar running smoothly in and out of your business. As an entrepreneur, you’re probably thinking, “Sure, but, easier said than done.”

We get it. Cash management is critical, but it’s hard to get right.

That’s why, as an advocate for small businesses in Central Texas, we dedicate a lot of resources to it. We don’t just offer accounts. We back them up with one-on-one, expert support from our local Waco team.

Below, learn more about treasury management services and why TFNB is the best place in Central Texas to find them—along with all the friendly, local support you need.

What is Treasury Management?

Before we get any further, let’s define what we mean when we talk about “cash management.”

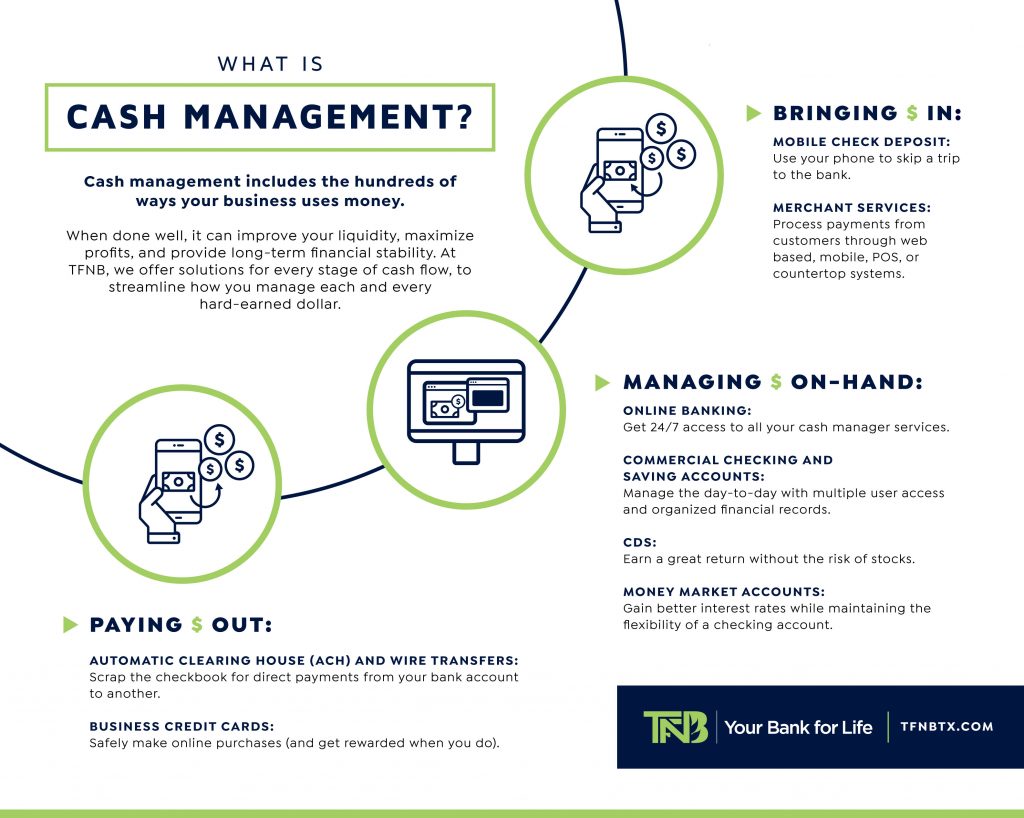

Treasury management refers to a broad area of finance involving the collection, handling, and deployment of capital within your business. It encompasses everything from making ACH payments and payroll to processing customer payments, making credit card purchases, and managing overall business cash flow.

To put it simply, it’s the management of incoming and outgoing money from your business. The end goal is to streamline cash flow processes, ensuring that your business always has access to the funds required to operate, and excess capital is used to achieve the maximum return on investment.

When done well, it can improve your liquidity, maximize profits, and provide long-term financial stability.

Let’s look at the various ways your business can benefit from having an effective treasury management system in place.

Why is Treasury Management So Important?

Cash is fuel for your small business; you have to put enough in your tank to get where you need to go each month. Ideally, you would generate enough cash from sales and other activities so you can meet your expenses, repay debts, and find ways to invest in the growth of your business. When you don’t, you either have to rack up debts to keep things running, or forfeit aspects of your business that could affect future cash-earning potential.

Here’s another important characteristic of cash flow: it’s honest. While it’s not hard to exaggerate your earnings with a little creative accounting, it is pretty hard to fudge the numbers on your cash flow statement. How your business manages cash is often indicative of the real financial health of your business. Additionally, cash management:

- Can make or break investors’ decisions. Banks or private investors look to cash flow statements when determining if they want to invest in your business or what the terms of the investment should be. Because cash flow offers a better indication of how financially sound a company is, it can be the thing that helps you get approved for a loan, or land a sizable investment when it comes time to scale.

- Helps you find ways to increase profitability. Cash flow statements have a way of indicating where the strengths and weaknesses of your operations are. By cutting unnecessary costs or increasing lucrative operations, you can fine-tune your operations to minimize activities that siphon away too much cash.

Looking to expand your cash management know-how?

Why not start with a good book? Here are a few highly-rated, practical reads to get you started:

Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine

Why Should I Choose TFNB for Treasury Management Services?

Our Waco bank offers treasury management services for each step of the process: from bringing cash in, maximizing your cash-on-hand, and paying cash out. But, truth be told, many banks offer these services—both well-known national institutions and local banks alike. However, we think there are distinct advantages to choosing TFNB for your cash management needs:

- Find everything under one local roof. At TFNB, we’ve made our bank a one-stop-cash-management shop for small business owners, because we know that time is something you don’t have a lot of. Here, you can manage all your business accounts—from checking to CDs— in one place with no extra stops or apps to keep track of.

With our online banking, you can handle much of the day-to-day monitoring, transactions, or mobile deposits from your desk. But, no matter where you are in Central Texas, you’re never far from one of our five TFNB locations; when you need to drop in, it’s easy to find time. - Experience exceptional service so you don’t have to go it alone. At times, running a business can feel overwhelming, so we try to help as much as possible when it comes to financial support.

Unlike many financial institutions today, we think banking is better when it’s personal. Our bankers develop relationships with our clients who are small business owners—they know you by name when you come through the door. That kind of relationship makes it easier for us to give you the right support when you need it, and it gives you a knowledgeable financial partner who understands you, your business, and the local Waco market. - Gain an influential community ally. We’ve been helping Central Texans who own and operate local businesses for 130+ years. We’re proud of our legacy of helping local business owners because we believe our responsibility as a local bank is to make this area a better place to live and work. From our experience, small businesses run by passionate local people are powerful. They can improve entire neighborhoods and even the city of Waco itself.

We make it a mission to find new ways to open doors for those looking to make an impact in our community. We do this by learning all we can about your goals, connecting you with other local organizations we know, and offering you financial solutions that will set you up for success tomorrow, not just today.

Cash Management Services: Find Everything You Need at TFNB

As a local business, you already know the benefits of choosing to keep your money local. When it comes to managing your cash, look no further than Central Texas’ own TFNB.

From mobile check deposit and merchant services to ACH, wire transfers, and business credit cards, we have every solution you need to develop a cash management strategy that rewards you. To talk with a banker about the resources available to you, drop by any location during lobby hours.

If you have any questions or would like to know more about our banking solutions, contact us at 254-840-2836

Learn MoreShare On